November in Japan is the season of autumn leaves, harvest festivals, and getting ready for winter. It’s also when many of us around the world reflect on what we’re grateful for, though not necessarily with a feast of turkey on the fourth Thursday like in America.

I’m grateful for some decidedly unglamorous things: my friend who knows where I keep my hanko and bank books. The password manager that stores all my account access details. The conversations I’ve finally had with my family about what I actually want.

These aren’t Instagram-worthy gratitudes, but they’re the foundation that lets me focus on more interesting things – like volunteering at Oyama Senmaida or making art.

Living in Japan has taught me that preparation and mindfulness go hand in hand. You prepare for earthquakes not because you’re paranoid, but because being prepared means you can relax and enjoy daily life without constant worry.

Same principle applies to getting your affairs organized. It’s not about being focussed on death; it’s about clearing that mental space so you can appreciate the good stuff.

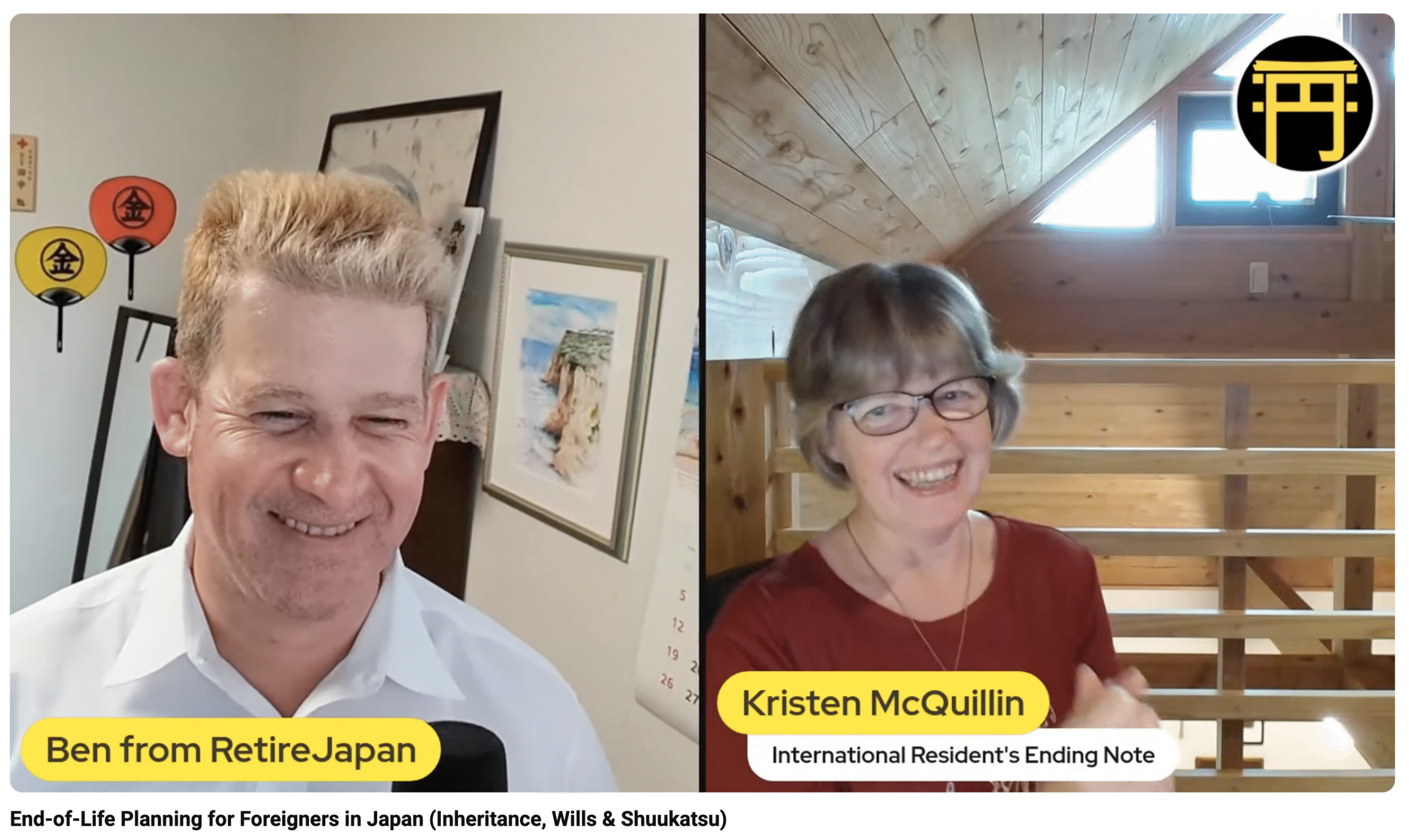

I’m also grateful for the people who helped me navigate this: the judicial scrivener who explained Japanese inheritance law, the tax professional who understood expat complications, the friend who shared her own family crisis story.

Getting organized as a foreign resident isn’t something you figure out alone. It takes a village that spans countries and cultures.

What are you grateful for this November? The practical stuff counts too.